Is the Transaction Chart a Cope?

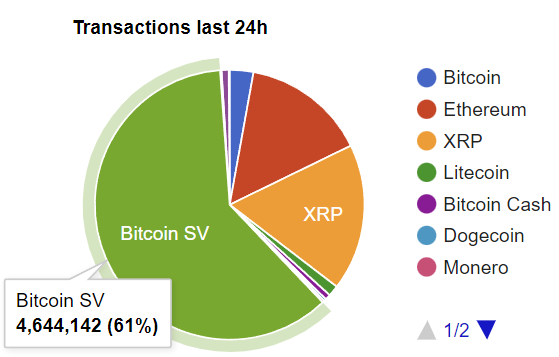

BSV does more transactions every day than Ethereum, BTC, and XRP combined. Does this mean BSV is winning?

If you are in BSV, you’ve seen this type of image a lot.

Maybe it evokes feelings of pride, excitement, or vindication. It’s certainly no small thing to have a blockchain handling a multiple of the daily transaction volume of Ethereum, the market leader, at a transaction cost millions of times cheaper.

It’s natural to put your best foot forward in a public setting. If you aren’t your own cheerleader, who will be? But, even the most polished organization has real problems which will take them down if they aren’t addressed. If you start seeing your public messaging as the full extent or your reality, ignoring your problems in the process, you are in for trouble. In BSV, we have to be careful about this dynamic - buying our own bullshit.

A closer look at the transaction chart reveals that we still have a long way to go, even in terms of catching up to crippled blockchains like Ethereum. At the end of the day, transactions don’t put food on the table, they are a cost. Paying customers put food on the table. Unfortunately for BSV, today’s transactions point to the blockchain’s potential and not much more.

Even calling this chart “the BSV transaction chart” in some ways misappropriates the credit. This chart is really the CryptoFights chart. For those out of the loop, CryptoFights is a play-to-earn game on BSV built by Fyx Gaming. Fyx Gaming started out on Ethereum and became one of the first companies to adopt BSV. Since coming to BSV, they have become major pioneers of BSV technology. Over 95% of total BSV transactions are CryptoFights transactions. If CryptoFights disappeared tomorrow, those transactions would disappear and the BSV success story of surpassing Ethereum’s daily transaction volume would disappear with it.

According to “State of the DApps”, Ethereum has a little over 68,000 daily active users. This doesn’t include speculators trading on a platform like Coinbase. Extrapolating from the CryptoFights leaderboard, the game has around 500 weekly active users. Duro Dogs, the second leading app by transaction volume, has just about the same number of weekly active users. I’d estimate that the total daily active users of BSV is between 1,000 and 2,000.

A couple thousand users isn’t enough to sustain businesses like Fyx Gaming or NFTY Jigs, the creator of Duro Dogs. The growth potential is there, but if that potential is not realized, both of these companies will go out of business. And, with the very limited BSV investor community, there may not be as much time left as there ought to be. In other words, without growing the number of paying customers, BSV businesses, and eventually BSV itself will fail.

Fortunately, the table is set for BSV user growth. Apps like CryptoFights, Duro Dogs, TDXP, Haste Arcade, Twetch, and more are rapidly improving both their products and onboarding. I wrote about how HandCash’s new fiat onramps are a major enabler of this improved onboarding. Over the coming months, I expect many BSV applications to begin allocating more of their budget to marketing and advertising. As companies improve at getting users in the door, onboarding them, and ultimately converting them to paying customers, I expect we will see BSV overtake Ethereum’s user numbers relatively quickly, all things considered, in part due to the viral effects of these types of applications.

The transaction chart is a great testament to BSV’s potential and a worthy part of a public pitch to its merits. But, BSV’s real problems, a lack of users and investors, persists, even though we do more daily transactions than Ethereum. The real value of apps like CryptoFights and Duro Dogs to the BSV network won’t come from paying transaction fees but will come from growing the pie of paying customers. I know both of these companies are working on just that.

Next time: Why NFTs will drive BSV adoption

Great article, as usual, Jack. What's concerning me at the moment is how much of the user / investor growth on ETH is driven by Ponzi-style speculation ... "Look how much money I'm making!" (Get friends to come in behind you.)

How can BSV drive adoption w/o appealing to the Ponzi-scheme-lover in all of us?